10 Easy Facts About Amur Capital Management Corporation Explained

Wealth and financial security can just be developed with investment. A clever investment could boost your money's worth and surpass rising cost of living.

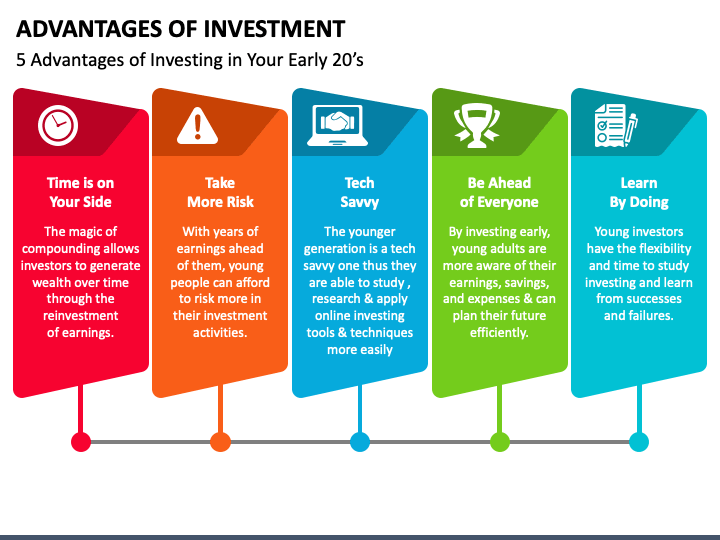

A life time of benefits awaits you when you spend, so there is no factor not to take the plunge. Spending has greater growth potential due to the fact that of intensifying and the risk-return compromise. Of all, why should you invest rather of merely conserving cash?

When spending in supplies, you need to be aware of the risks entailed. While there are risks involved, there are also lots of benefits of buying supplies. Below are a few pros of investing: Purchasing top quality investments can make you added income. You might be able to use your return on investments as an added income source often.

Amur Capital Management Corporation - An Overview

Savings are essential, no matter just how you cut it. In enhancement to having a "wet day" fund, investing can provide more advantages relying on your hunger for danger. This can be seen in the. The development of your cash will be achieved by spending it. You can anticipate to make returns on your money, such as supply, certification of deposit, or bond financial investments, if you spend for a long time.

Without spending and growing your cash, you'll actually shed cash over time. Costs increase every year due to rising cost of living, and your money sheds its getting power as a result. mortgage investment corporation.

The Best Guide To Amur Capital Management Corporation

As paychecks obtain fatter, customer need rises, causing greater earnings for firms. By recognizing the 4 stages of business cycle development, optimal, tightening, and trough one can better comprehend exactly how the economic situation functions. When it involves spending, a typical issue among people is the threat of shedding their cash.

The Definitive Guide for Amur Capital Management Corporation

It is likewise really advantageous to spend because this can save you on tax obligations! Cash invested in a 401k, SEP IRA, or Standard IRA will certainly not be exhausted in the year it is made.

If you would certainly rather pay taxes now, you can select to make use of a ROTH IRA. This choice allows you pay tax obligations currently and avoid paying taxes later. You can even take pleasure in reduced resources gains tax obligations in taxed accounts than you would if you worked 9-5! The examples above are simply standard ones.

Not known Factual Statements About Amur Capital Management Corporation

Various trading methods need to be taken into consideration before settling on a financial investment. This can be advantageous to capitalists who spend in stocks.

Supply investing has both benefits and negative aspects. There are a great deal of Stock financial investments have traditionally produced significant returns over the lengthy term, however they additionally include substantial risks. It is feasible to expand the risks connected with stock investing is possible by buying various stocks, markets, and geographies.

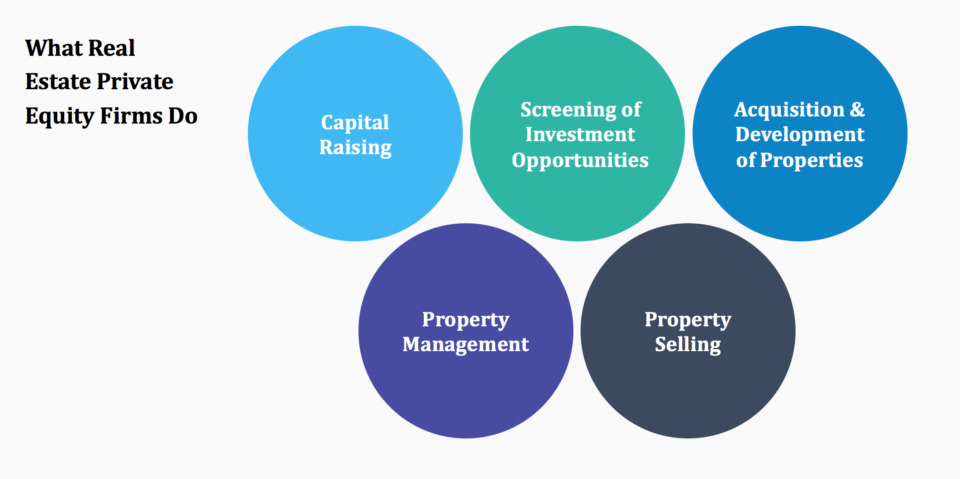

uses a varied and consistent portfolio of actual estate assets. Examine out Saint Investment's cost-free resources today! Head Of State of Saint Financial Investment Team Nic is a twenty years seasoned specialist in investing and capital raising, concentrating on Property and financial obligation markets. With Saint Financial Investment Team, he leads large-scale distressed possession acquisitions and cutting-edge syndications for financiers.

7 Simple Techniques For Amur Capital Management Corporation

: Previous efficiency is not a guide to future performance. Your capital is at danger. The value of investments and any kind of earnings is not guaranteed and can decrease in addition to up and may be affected by currency exchange rate variations. This suggests that a capitalist might not get back the amount spent.

Financiers must speak with their own professional consultants for advice on any investment, lawful, tax, or accounting concerns associating with an investment with Columbia Threadneedle Investments. The reference of any kind of details shares or bonds must not be taken as a suggestion to deal - accredited investor. Columbia Threadneedle Investments does not provide any kind of financial investment recommendations

The evaluation consisted of in this record has been generated by Columbia Threadneedle Investments for its very own financial investment administration tasks, may have been acted on before publication and is offered right here by the way. Any point of views shared are made as at the date of magazine but are subject to alter without notification and ought to not be seen as financial investment advice.

Everything about Amur Capital Management Corporation

None of Columbia Threadneedle Investments, its supervisors, officers or staff members make any kind of representation, warranty, guaranty, or various other guarantee that any of these forward-looking statements will certainly confirm to be exact. Info obtained from external resources is thought to be trusted, however its accuracy or completeness can not be assured. Provided by Threadneedle Asset Administration Limited.